Coronavirus – An Investment Perspective

February 26, 2020 4:23 amRecently, the market has dropped as fear increases over the spreading coronavirus threat. Is this new disease something to cause investor panic or should any market drop be viewed as an opportunity?

Back in November of 2002, the world was introduced to another new disease, SARS. Like the current disease, SARS first appeared in China and was a type of coronavirus. It was not until March 12, 2003 that the World Health Organization (WHO) issued a global alert for a severe form of pneumonia.

SARS spread across the world with cases reported in North and South America, Europe, and Asia. According to the CDC, 8,098 people worldwide contracted SARS during the outbreak. The mortality rate of those contracting the disease was just over 9.5%. The outbreak was declared over by WHO on July 5, 2003.

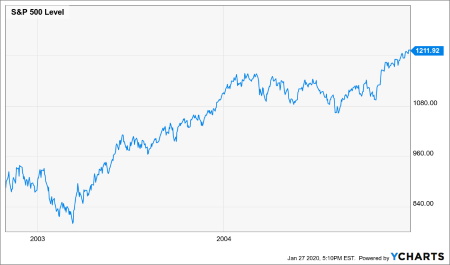

How did the US stock market react to the SARS epidemic?

Initially, the market (as measured by the S&P 500) dropped sharply, falling from approximately the 940 level in November, 2002 to a low of about 800 on March 11, 2003, a decline of almost 15%. That low, by the way, was the day before WHO issued its global alert.

As of right now, it appears that this newest coronavirus is more easily spread than SARS but carries a decidedly lower mortality rate around 3% (but, of course, that could change). How those two factors interact to impact world health is unknown at this time. Certainly, the Chinese government appears to be acting more quickly this time around although many observers think it is still a case of “too little, too late.”

While I can’t presume to know how this will turn out, it seems as though the health authorities here in the US, at least, are ahead of where they were with SARS. Bottom line, I think it likely that any market downdraft will be short lived and, more importantly, the human toll will be less.

Post from: Insights