Holding Cash to Avoid Losing Money? Think Again

January 11, 2020 3:56 amI have been lucky to have been blessed with seven children. Most of them are now fully adult. The majority have yet to start investing for the future despite the occasional admonishment from me. That’s a really bad idea for them and for anyone who has followed the same path.

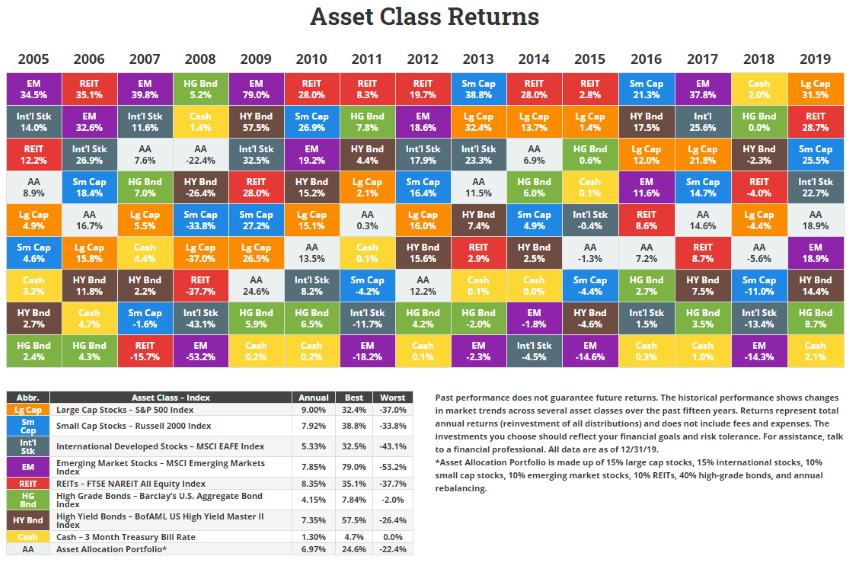

The chart below offers a very simple and elegant explanation of why everyone needs to get their money invested and working for their future. There are nine asset classes represented with the return to each class indicated for each of the 15 years shown.

If you look carefully, you will see that the return to cash (think of your bank account or money market fund as an equivalent) has been below the median for all but 3 of those years.

For the 3 years where it was above the median, the highest return was a mere 2.0%!

Intellectually, you may be able to grasp the importance of the information in the preceding paragraph. But to make sure, let’s put the implications into real world, dollar and cents, terms.

If you had put $10,000 into “cash” at the end of 2004, that $10,000 would have grown into $12,164 by the end of 2019. What about the other asset classes?

| Asset Class | 2019 Value | Cost of Holding Cash |

|---|---|---|

| Lg Cap | $36,447 | $24,283 |

| Sm Cap | $31,411 | $19,247 |

| Int’l Stk | $21,782 | $9,618 |

| EM | $31,012 | $18,848 |

| REIT | $33,391 | $21,227 |

| HG Bond | $18,390 | $6,226 |

| HY Bond | $28,040 | $15,876 |

The table makes clear the real cost of holding cash. It underperformed each and every one of the other asset classes. While, of course, the future will be different from the past, this sample period covers periods of economic boom and bust and extremes of market strength and weakness.

One last point needs making. To add injury to insult, over this period the inflation rate, as measured by the Consumer Price Index, averaged 2.0%. So, the $12,164 in your bank account at year-end 2019 would have purchased even less in real terms than the $10,000 you started out with.

The conclusion to be drawn is obvious. Don’t sit on your cash for years. Invest! Invest even if you’re scared, even if you can’t see the future clearly. Your future self will thank you!

Post from: Insights