First Quarter 2024 Market Review

April 10, 2024 4:04 amThe Trend Is (Still) Your Friend

It’s an election year in the United States, inflation is still shrinking the buying power of everyone’s pocketbook, wars have broken out all over the globe, the national debt has topped $34 trillion with no sign of cresting, the banking system is on the brink of collapse and the Federal Reserve keeps pushing off the rate cuts they “promised.”

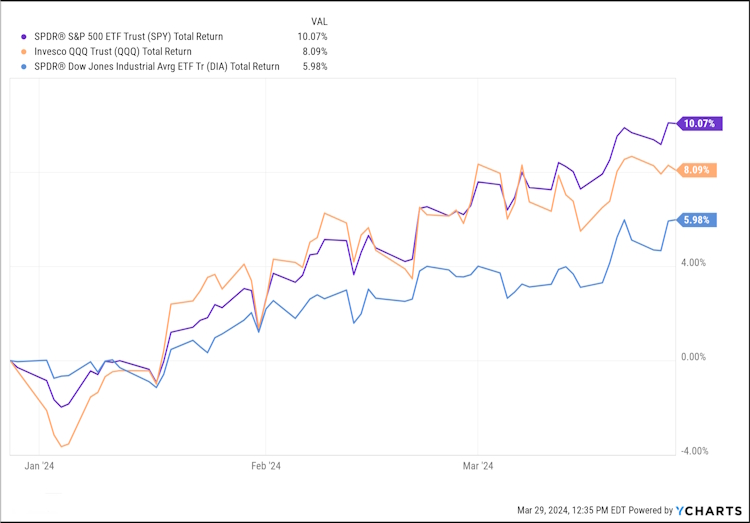

Sounds like an explanation as to why everyone’s investment account is down year to date except that it’s not the case. The S&P, Nasdaq, and Dow Jones Industrial indices all produced solid gains for the quarter as measured by the large ETFs that track them (SPY, QQQ, and DIA).

Note that we are using the Index ETFs as that is how the average retail investor would invest in an index. We will be using these going forward.

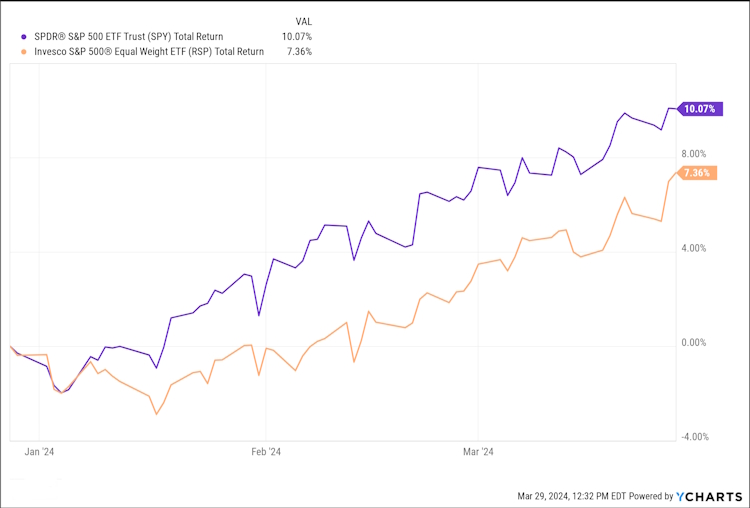

Looking at an equal-weighted portfolio (RSP)versus the tech-heavy, market cap-weighted one (SPY), we see that, unlike much of 2023, the smaller companies are participating in the market’s rally, continuing the trend we saw in Q4. This is also indicated by the fact that the S&P 500 ETF, SPY, outperformed the Nasdaq for the quarter, something that we have not often seen recently.

So, why is the market going up? Let’s look under the hood at those things that we believe drive the market.

The Business Environment

Overall Q4 2023 earnings were slightly subpar with 73% of S&P 500 companies reporting actual Earnings Per Share (EPS) above analyst estimates, which is below the five-year average of 77%. 73 of the 500 companies issued negative guidance for Q4 which is above the 10-year average of 62 out of 500. Overall, however, the S&P 500 reported growth in earnings of 4% making this the second straight quarter of year-over-year growth. Source: Earnings Insight Infographic: Q4 2023 By The Numbers

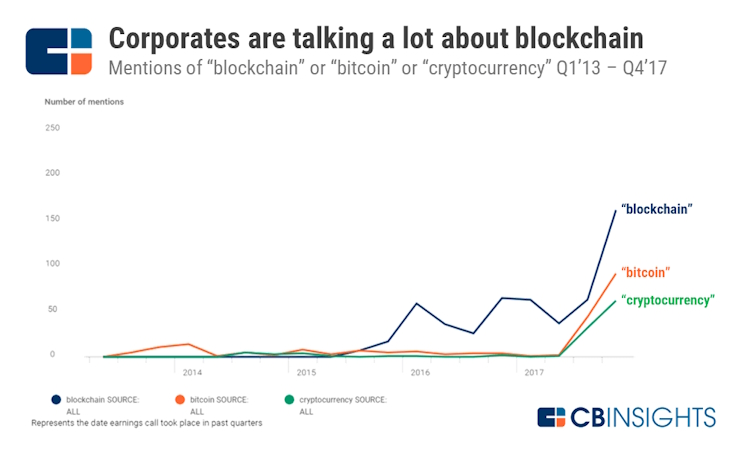

Unsurprisingly, 179 companies cited AI in their earnings calls, which is just below the all-time high of 181 during Q2 of 2023. This is highly reminiscent of 2018 when Bitcoin had reached an all-time high of $20,000 and the fear of missing out was at fever pitch. The fever peaked when a publicly traded company called Bioptix, which was known for having a veterinary products patent, changed its name to Riot Blockchain and went from a price of $8.00 per share to more than $40.

The company still exists under the name Riot Platforms and is currently trading around $12 per share.

The Economy

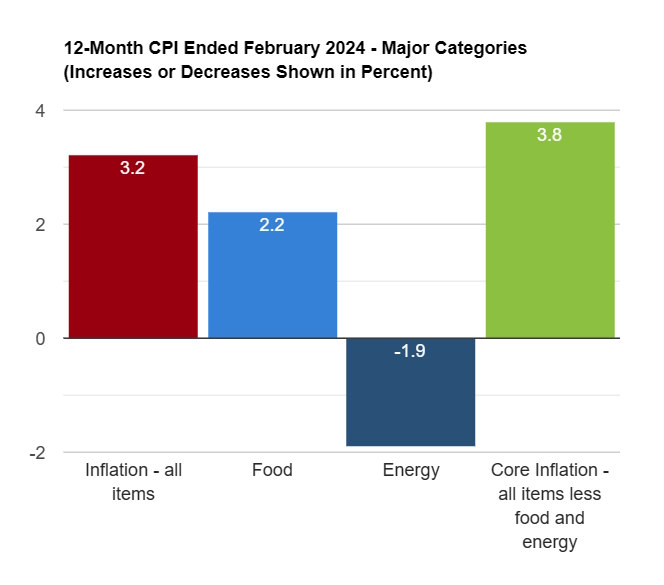

Starting with the inflation front, which is a key driver of the Fed’s interest rate policy, Consumer price increases remain stubbornly high according to USInflationCalculator.com

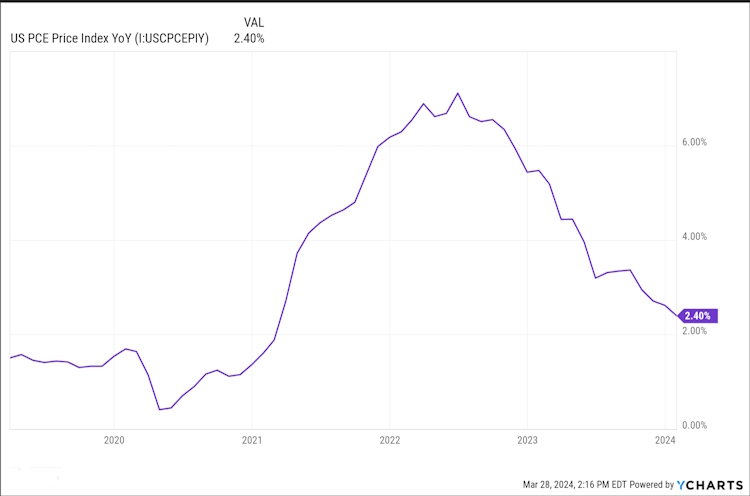

While the preferred measure, PCE has showed more improvement, it is still above pre-pandemic levels.

Larry Summers, an economist and former Treasury Secretary for President Clinton and Director of the National Economic Council for President Obama, published a study in 2022 where he claims that the changes to the CPI calculations over the years are dramatically understating the current rates of inflation. Of course, this would come as no surprise to John Williams over at Shadowstats.com who has been publishing alternate Data based on 1980 and 1990 methodologies for over a decade. According to Williams, based on 1990 methods of calculation, inflation is hovering right around 8% and well over 10% based on 1980 methods. We’re sure that while John welcomes validation from someone like Summers, he takes no pleasure in being right as these high prices always impact those with the least ability to deal with them.

As we have stated before, the Fed needs inflation to deal with the growing national debt as we are way beyond the ability to just pay it off. However, it is not wise to publicly state such policies, so instead, they change the calculations and hope we don’t notice. Even with the most recent “changes” though, we are still above the “ideal” target of 2%.

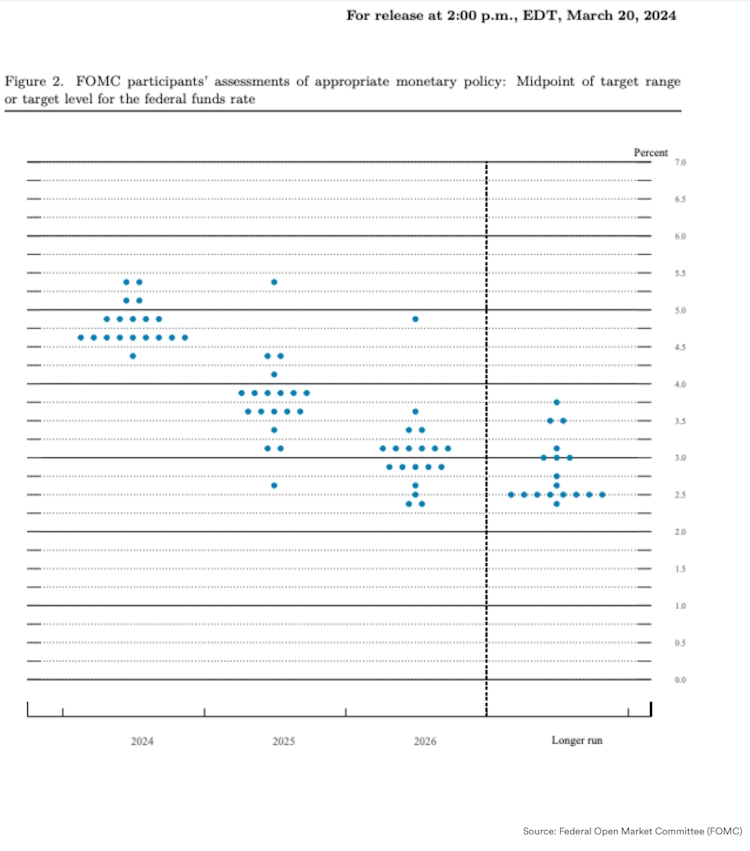

Yet Powell & Co. are still projecting three rate cuts this year according to their latest Dot Plot.

Call us skeptical, but we do not see a compelling reason for rate cuts at this time. As we noted above, inflation is still above the target rate and recent data indicates the rebound in inflation may be prolonged. Shipping troubles, even before the incident in Baltimore, and geopolitical tensions in the Red Sea have contributed to rising prices.

The economy and job market, as measured by the Fed, continue to grow and areas such as health care, apartment rents, and restaurant meals still experience persistently high inflation. So, if the economy is at least stable, if not growing, and the job market is still healthy, there is no economic justification for lowering interest rates.

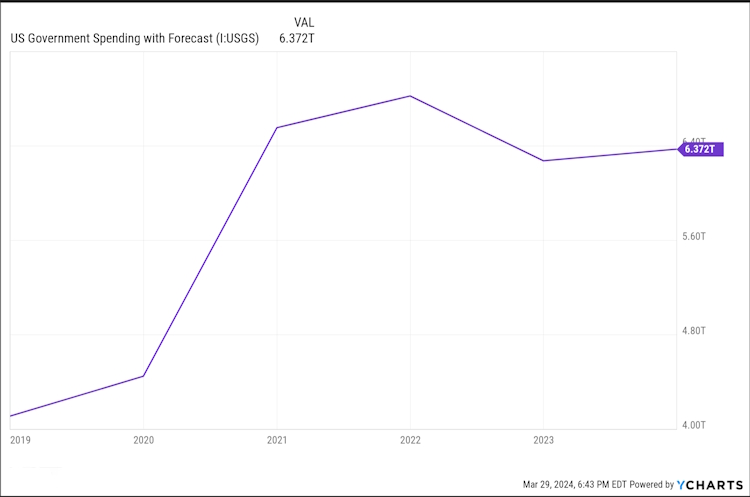

US Real GDP Growth, measured as the year-over-year change in the Gross Domestic Product in the US, adjusted for inflation is at 3.40%, compared to 4.90% last quarter and 2.60% last year. How much of this is organic growth versus stimulated growth is difficult to accurately assess. Although growth is down from the peak in 2022, post-pandemic spending is still alarmingly high for what we would expect to see based on Keynesian economic models which almost all government economists claim to follow.

When the government injects substantial funds into the economy through deficit spending, it can provide an immediate boost. These funds flow into various sectors, creating demand for goods and services. The resulting economic activity can lead to higher GDP growth rates, lower unemployment, and improved consumer sentiment. In the short term, this can indeed make the economy appear healthier.

The employment front is a little easier to examine and the strong headline numbers reported each month appear slightly misleading. The headline number focuses on quantity, but it doesn’t differentiate between full-time, part-time, or temporary positions. The BLS considers someone employed if they work just one hour per week, so a surge in low-paying, gig economy jobs or someone taking on multiple jobs could inflate the total count without necessarily reflecting robust employment quality.

The headline figure also doesn’t account for changes in labor force participation. If discouraged workers drop out of the labor force the unemployment rate may appear lower, even if the overall job market isn’t thriving. Finally, the initial job reports are subject to revision as more accurate data becomes available. For instance, looking at the February report we see that:

The change in total nonfarm payroll employment for December was revised down by 43,000, from +333,000 to +290,000, and the change for January was revised down by 124,000, from +353,000 to +229,000. With these revisions, employment in December and January combined is 167,000 lower than previously reported.

So, if things aren’t as rosy as they appear, why are we at record highs for all three indices? The most popular explanations that we have heard, in no particular order are:

- The markets are forward-looking, so investors are pricing in future profits today and Artificial Intelligence is going to unleash the greatest of innovation and prosperity since the internet.

- The bond market knows more than all stock market investors and Federal Reserve governors put together and the 10-year Treasury yield is currently 4.2% versus the Fed Funds Rate of 5.31% indicating future rate cuts of over 110 basis points (BPS), which is bullish for stocks.

- The stock market is simply in an uptrend and Stock market trends often exhibit a remarkable persistence. They tend to stay in place until certain conditions or events such as central bank policy shifts, regulatory changes, technological breakthroughs, or unexpected events (like a pandemic) prompt a change.

All three explanations are reasonable, and we have seen nothing technical that indicates that, without a catalyst, there is no reason why the indices won’t continue the uptrend.

So, with that, let’s look at the possible catalysts that could cause the trend to end, also known as:

Things (Still) Keeping Us Awake at Night.

Chinese Real Estate Collapse

While the focus is on real estate because that is an area where we have some available information, our bigger concern is the Chinese economy as a whole. Evergrande, a major Chinese real estate developer, filed for bankruptcy in August of 2023. A Hong Kong court has now ordered the liquidation of the company after it was unable to restructure the $300 billion it owed investors.

Evergrande has become symbolic of a Chinese economy that faces some major near-term obstacles: slowing growth, increasing debt , and a shrinking workforce. This is reflected in the performance of their stock market. Using shares of Blackrock’s China Large-Cap ETF (FXI) as a market proxy, not only has the market not recovered from pandemic related weakness; shares have fallen well below the levels reached in 2020. This is not what you would expect to see from the world’s second largest economy if it were in good health.

Again, as is so often the case, our concern is not with the crisis itself, but with how those in power react to the crisis. Diana Choyleva, a senior fellow on China’s economy at the Asia Society sees the potential for deflation ahead as the Chinese economy struggles with several issues going forward. In November, consumer prices in China fell at their fastest rate in three years. Choyleva says. “If China is having severe deflation at home, pretty much the only choice left would be [for it] to export deflation.” This means that U.S. businesses would then be forced to compete with a flood of “discounted” Chinese products which would threaten revenue and profit margins. Or worse, China could try and deal with deflation the way we did during the Great Depression and “go to war” by deciding that “now” would be the best time to unify with Taiwan.

Neither of these scenarios is good and our government’s response to either of them might exacerbate the problems.

BRICS+

If the Chinese were to decide that military conflict is their best solution to overcoming their economic troubles, they would likely try to mitigate the risk of dollar-based financial sanctions in advance of taking any actions.

While the 2023 BRICS Summit did not yield an official announcement regarding a new currency, there is still a strong desire, especially by Russia and China, to establish one. Even if they are not successful in doing so, there are still many actions including currency swap agreements, creating alternative financial systems such as “development banks” operating outside of the global financial system, and even counter-sanctions as the BRICS have considerable control over global energy markets, critical minerals, and natural resources that are vital to our economy.

Social Security

According to the latest Social Security fact report, released in August 2022, without any changes, the Social Security system is now projected to be insolvent in 2035 (that’s 11 years from now), while Medicare is expected to face insolvency even sooner, in 2028 (just 4 years away). Again, we do not fear the crisis, as much as the response to the crisis.

While we have not seen any reasonable fix for Medicare, several steps can be taken to fix the Social Security system. When Social Security was enacted in 1935, the average life expectancy of an American woman was 64, and 60 for an American man. If we had simply adjusted the Full Retirement Age (FRA) in line with the average life expectancy, the Full Retirement Age today should be either 76 or 77 according to the CDC (depending on whether you are using “at birth” or “at age 21” life expectancy). Even Larry Fink from Blackrock, whom we hardly ever agree with, mentioned the same thing in his annual letter to investors.

Of course, a change of this magnitude is easier said than done and any attempt to make those changes overnight would result in political uproar. A measured approach such as incrementally raising the benefits ages by one year would have a greater chance of acceptance.

For example, if the system were changed so that every two years the age limits across all benefit levels (age 62 to 70) were raised by one year, a 65-year-old who planned on waiting till age 70 to maximize benefits, would have to wait until age 72 instead. While there is no scenario where everyone would be pleased, given the choice of waiting two years or a potential benefit reduction of 23 to 25%, most rational people would take the delay. It might also create greater incentives to save for retirement so that people could still quit working at a reasonable age.

This is just one idea. Unfortunately, the ideas being floated around in Washington D.C. tend to be on the opposite end of the spectrum. Perhaps the most troubling being the elimination of pre-tax benefits for 401K programs in order to collect more taxes now, which in theory would be targeted to shore up social security.

It’s not that we doubt the sincerity of our elected politicians to keep their promises, but we recall that as part of the Health Care and Education Reconciliation Act of 2010, which was a companion bill to the ACA, President Obama signed into law a major overhaul of the student loan system to save an “expected” $68 billion which would be used to improve the quality of the education system and make it more affordable.

Today, student loan forgiveness has become a political issue while college costs have continued to rise and education outcomes continue to deteriorate.

Artificial Intelligence

As we have noted above, the investing meme of the year has been Artificial Intelligence (AI). Before going any further, we should distinguish between AI and Generative Pre-Trained Transformers, better known as GPT.

AI has been around since the 1950s when IBM researcher Alex Bernstein created the world’s first complete chess-playing computer program in 1957, which ran on an IBM 704 mainframe. The issues surrounding its advancement were on the hardware side. There just wasn’t enough computing power back then to allow the programmers to develop more sophisticated programs. AI can be applied to nearly any complex analytical task.

GPT is relatively new and while it can be effective at some tasks, it still has some serious limitations as observed during the rollout of Google’s version of an AI chatbot called Bard.

Still, the technology does have a lot of promise, especially with the rapid advances in computing power that we are seeing. But, instead of me telling you about it, how about letting the technology literally speak for itself?

“Hey, Copilot (the Microsoft Edge version of an AI-powered search companion), which industries or sectors of the economy could benefit the most from the application of Artificial Intelligence technology?”

Its answer:

Certainly! As an investment analyst, let’s explore the sectors poised to benefit significantly from the application of Artificial Intelligence (AI) technology. These advancements have the potential to revolutionize various industries:

1. Manufacturing:

- The manufacturing industry stands to gain significantly from AI due to increased data accessibility. With more data available, businesses can apply AI and machine learning techniques to:

- Reduce task time.

- Improve accuracy.

- Handle administrative tasks efficiently.

- As digitization accelerates, we expect wild experimentation across industries, which will eventually benefit consumers as well.

2. Autonomous Vehicle Navigation:

- AI has already demonstrated remarkable capabilities in autonomous driving. Key areas where AI excels include:

- Recognizing driver patterns.

- Predicting accidents.

- Accounting for road variables.

- These advancements not only enhance safety but also hold immense potential for accident prevention and the autonomous driving verticals.

3. Education:

- AI can transform education by enabling holistic analysis and instructional optimization. Rather than merely optimizing performance against a standard, AI can:

- Tailor learning experiences to individual needs.

- Intelligently adjust to each student’s pace and learning style.

- Despite limited resources, AI can help achieve better educational outcomes for diverse populations1.

4. Medical Testing and Diagnosis:

- AI algorithms can analyze medical images (such as X-rays, MRIs, and CT scans) with high accuracy.

- Early disease detection, personalized treatment recommendations, and drug discovery are areas where AI can revolutionize healthcare2.

5. Healthcare Delivery:

- AI-powered chatbots, virtual assistants, and predictive analytics can streamline healthcare services.

- Improved patient outcomes, reduced administrative burden, and cost savings are some of the benefits AI brings to healthcare.

6. Carbon Emission Reduction:

- AI can optimize energy consumption, monitor emissions, and enhance sustainability efforts.

- Industries aiming to reduce their carbon footprint can leverage AI for efficient resource utilization.

7. Agriculture:

- AI-driven precision agriculture can enhance crop yield, monitor soil health, and optimize irrigation.

- From automated planting to disease detection, AI can revolutionize farming practices.

8. Customer Service:

- AI-powered chatbots and natural language processing enable efficient customer interactions.

- Enhanced customer experiences, reduced response times, and cost-effective support are the outcomes of AI in this sector.

Remember, while AI offers immense potential, prudent investment decisions require assessing each industry’s specific context, regulatory environment, and long-term viability. As an investment analyst, staying informed about AI trends and their impact is crucial for making informed recommendations to clients and stakeholder.”

So, there is the answer from a ChatGPT program (including the pictures), created after searching through multiple articles and posts with links to all citations. This was done in about the same amount of time that it took to type in my prompt. It’s an example of the ability of GPT systems to enhance productivity. It’s also an example of why we do not feel threatened by the technology.

First, is the information accurate? Nobody knows and it would still require a review of the citations behind the various assertions made as surely some may be based on scientific studies while others are pure speculation.

Second, as much as we like to give these programs human characteristics, there are no emotions and there is no real intelligence as measured by human standards. They are and always will be just an application of high-level mathematical algorithms. They care nothing about us and will be limited and probably slanted by the biases of the person writing the program. Even if a program writes the program, the original coding was still influenced by humans and constrained by code.

Looking forward to Q2

At this point in time, we have no reason to suspect that a change in the market trend is imminent. That said, valuations are on the challenging side and the world is always in flux. It is not a matter of “if”, but “when” something, good or bad, will happen that will impact the prices of the various investment assets we use for our clients. We will continue to look for opportunities to capitalize on the innovations that will be driven by the application of AI as well as using AI to help us find them.

We are so very thankful to be able to do what we do, combining faith and finances, and even more thankful to have you along with us on this mission.

As always, if you have any questions, concerns, or just want to catch up beyond the information provided here, please never hesitate to contact us.

Post from: Insights